how much is the property tax in san antonio texas

Property tax rates in Texas are recalculated each year after appraisers have evaluated all the property in the county. For 2018 officials have set the tax rate at 34677 cents per.

Monday Is The Deadline To Reduce Your Property Tax Bill By Filing A Protest Kens5 Com

The following table provides 2017 the most common total combined property tax rates for 46 San Antonio area cities and towns.

. 212 of home value Yearly median tax in Bexar County The median property tax in Bexar County Texas is 2484. The tax rate varies from year to year depending on the countys needs. Start the process of receiving your San Antonio property tax loan by filling out our online application.

The proposed property tax relief measures would cut 938 million from the citys. Pursuant with the Texas Property Tax Code properties are taxed according to their fair market value. Contact our San Antonio Texas property tax lending professionals today.

You will need to send your payment to the Bexar. Paying by mail is also an option. A disabled veteran may also qualify for an exemption of 12000 of the assessed value of the property if the veteran is age 65 or older.

China Grove which has a combined total rate of 172 percent. The tax rate varies from year to year depending on the countys needs. After you login you will be able to view your property tax information and make a payment.

The Fiscal Year FY 2023 MO tax rate is. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact. For example the tax on a property appraised at 10000 will be ten times greater than a.

12000 from the propertys value. A San Antonio neighborhood as seen from the air in San Antonio Texas on Feb. Maintenance Operations MO and Debt Service.

Texas Alcohol and Tobacco Taxes. San Antonio TX 78207 Phone. For comparison the median home value in Bexar County is 11710000.

Property Tax Rate The property tax rate for the City of San Antonio consists of two components. They are calculated based on the total property value and total revenue. Texas has a tax of 20 cents per gallon of wine and 19 cents per gallon of beer.

San Antonio Property Taxes Range San Antonio Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe you dont. For 2018 officials have set the tax rate at 34677 cents per 100 of taxable value for maintenance and operations. Under Section 3102 of the Texas Tax Code taxes are issued on OCTOBER 1st of each year and are due upon receipt of the tax bill and become.

Bexar County Texas Property Tax Go To Different County 248400 Avg. Liquor on the other hand is taxed at 240 per gallon. What is the average property tax in San Antonio Texas.

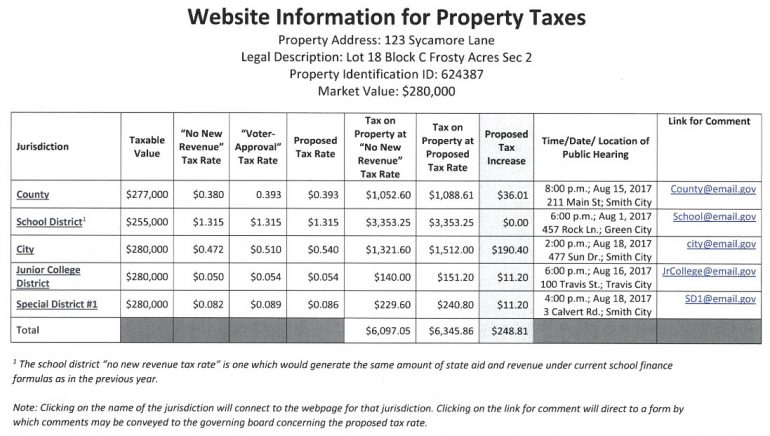

Property Taxes In Texas This Is How To Check How Much You Re Paying Where Your Money Is Going Your Proposed Rate

Fort Bend County Ranks Very Low Among Places Receiving The Most Value For Their Property Taxes

Bexar County Leaders Approve New Property Tax Exemptions Community Impact

Ball Property Tax Servives Property Tax Consultant Resume Sample Resumehelp

How To Protest Your Property Valuation San Antonio Business Journal

All Of Us Are At A Breaking Point San Antonio Bexar County Leaders Look To Austin For Property Tax Relief

If You Think Your Property Tax Bill Will Drop This Year Think Again Here S How You Can Fight An Increase

Property Tax Consultants In Austin San Antonio Tx Paradigm Tax Group

Local Tax Rates And Exemptions 2018 Texas Cities San Antonio Report

Can Texas Fix Its Broken Property Tax System These Lawmakers Ideas Might Not Have A Chance

San Antonio To Cut Property Tax Rate Expand Homestead Exemption

Tax Breaks For Developers Under Scrutiny In San Antonio Texas Capitol San Antonio News San Antonio San Antonio Current

Significant Changes Coming To Texas Property Tax System Texas Apartment Association

U S Cities With The Highest Property Taxes

Hotel Occupancy Tax San Antonio Hotel Lodging Association

Editorial Vote To Approve Amendments On Tax Relief

Tax Relief Is Coming With The 2023 Budget Saobserver

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Property Tax Relief Comes To San Antonio And No Change In District 3 Lines The City Of San Antonio Official City Website